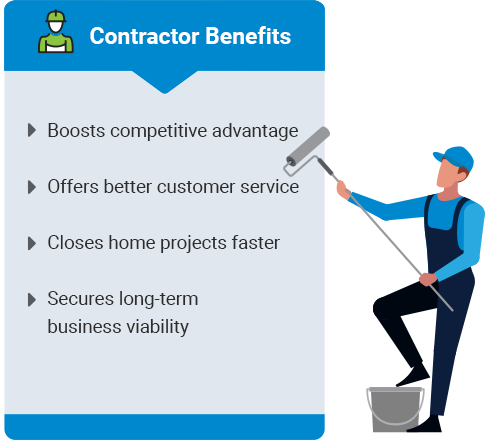

Staying Ahead of the Competition — Contractors lose jobs when they don't offer financing. Customers will either drop the project once they hear the bid or they'll seek out a contractor who does offer financing. Stay ahead of the competition by providing options to the customers who need help financing a project that costs more than $5000.

Giving Customers Options — Customers appreciate having options. When you approach customers with financing options, you make it easier for them to choose you for your services. Providing convenient options, such as Same-as-Cash loans and low monthly payment loans, puts bigger projects with higher-quality materials within reach for your customers. Having options that work for their individual situation and knowing what options they qualify for makes it easy for them to commit to a project.

Close Projects Faster — When you offer financing to your customers through EnerBank, you’re more likely to close the project, and can secure funding in one visit.

Potential for Business Expansion — By empowering your customers to pay for their home improvement projects, you open the door to a greater variety of customers and projects. This leaves space for growing and expanding your business with more projects at a higher price point.

What is Contractor Financing and How to Offer it

When hiring a contractor for their home renovations, not every homeowner has a good idea of how much quality services and materials will cost. Or, they don't have the funds they need on hand to pay for their project. This means they may back out after the initial bid, choose lower-quality materials, or reduce the size of the project to save money. Contractor financing for customers puts their dream projects within reach, without compromises — and will empower you to grow your business and increase sales of larger jobs.

Get Paid on Time with Contractor Financing

When pursuing a home imporvement project, customers love options. Regions | EnerBank USA's contractor financing offers exactly what your customers are looking for: ease & convenience.

What Is Contractor Financing?

Contractor financing provides an easy way for your customers to pay for their home improvement projects — and for you to get paid quickly and on time. There are several types of financing:

- Business Lines of Credit — Flexible funding from a bank or credit union. It can be tapped at any time for the amount needed but has a set limit. You only repay interest on outstanding balances.

- Business Credit Cards — An unsecured form of credit with lower limits when compared to lines of credit. This type can have high interest rates and fees.

- Factoring — A company takes on your customer accounts for a fee and then gives you a percentage. This is an expensive option and may lead customers to believe your company does not have the cash it needs.

- Project Based Financing — You partner with a stable lending bank that has a home improvement industry focus and can provide support where you need it.

Here at Regions | EnerBank USA, we offer project-based financing, or what we call “payment options.” As a part of a payment options program, you can easily offer your customers loans, with the application, underwriting, credit decisions, and funding all handled by us. This means you provide a great value-add to your customers with minimal lift on your end.

Many customers don’t want to spend their cash to make repairs and renovations in their homes. So, they turn to a variety of financing options that allow them pay over a period of time, including:

- Personal loans from traditional banks, credit unions, and online lenders.

- Setting a savings goal and setting aside cash over several years. Or they may complete several smaller projects as funds become available, sometimes choosing lower-quality service and materials to make the budget stretch.

- Receiving financing from a large home improvement corporation, such as Lowes or Home Depot.

- Obtaining a financing plan directly from a contractor they hire to do the work. These plans typically include same-as-cash loans or low monthly payment loans that are paid back over time.

For homeowners, getting financing directly from their contractor is generally the most straightforward route. They know they’re getting trustworthy financing that works directly with their contractor and they’ll be provided with the options they need to make an informed decision. Homeowners appreciate the ease and convenience of being able to apply for a loan in their home.

By working with a trusted lender like Regions | EnerBank USA, contractor financing programs let you offer a variety of payment options directly to your customers.

How Do Contractors Offer Financing to Their Customers?

Contractors can begin offering financing by teaming up with a lending company that integrates with the contractor’s existing services.

These financing plans give your customers something powerful: options. Having options means customers can choose the loan that works best for their financial situation. More options for customers means more business for you, as well as larger, more profitable projects.

How Do Contractors Offer Financing to Their Customers?

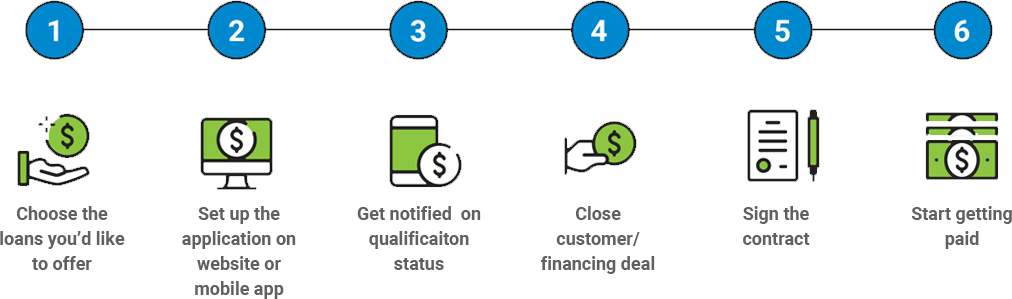

The Regions | EnerBank process is made simple so you can focus on growing your business.

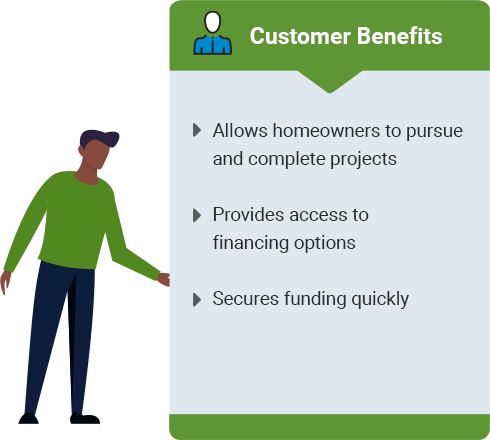

Why Is Offering Contractor Financing for Customers Beneficial?

Contractor financing programs are helpful to both customers and contractors. Here are the primary benefits.

How Does Contractor Financing Work with Regions | EnerBank USA?

We developed our tools and technology specifically for the home repair and renovation industry. This means you can easily integrate offering financing into your existing sales process. Generally, here are the steps involved:

- PreQualify

- Help your customer discover their purchasing power without a major hit to their credit* . This helps you better scope the project and recommend materials.

- Loan

Application - We offer three paperless applications for your customers: Mobile Loan App, Online Loan Application, and Loan-by-Phone.

- Credit

Decision - Customers can receive a credit decision in minutes. If additional documents are needed, the customer can take care of that while you’re still in the home. Once everything is complete, the customer can sign electronically, and the loan is complete.

- Request

Funds - Once the job starts, you can easily request funds through our PartnerPortal system. The customer can approve your request via text message. Funds are then deposited into your account, usually within 24 hours.

- Make

Payments - Customers can make payments on their loan online, over the phone, through the mail, or via overnight delivery. They can also set up recurring payments.

*There's no hard credit pull during the PreQualify process. If the customer chooses to apply for a loan, a hard check will take place.

What Are the Qualifications to Offer Financing from Regions | EnerBank USA?

To offer payment options from EnerBank, you must meet the following qualifications:

- 3+ years in business

- U.S.-based business

- $500,000 annual residential sales

- $5,000 minimum average job size

- Satisfactory business credit report

- Satisfactory BBB report

- Licensed and insured

- Pass financial review

Best Practices for Offering Customer Financing as a Contractor

Are you ready to start offering contractor financing to your potential customers? Doing so will expand your business and give customers more options, but sometimes, it isn't clear how to best offer payment options. As you start offering financing to your customers, consider adopting these best practices.

Advertise Payment Options — Chances are you're already trying to get your name out there with social media ads, signs around town, newspapers, radio, newsletters, word of mouth, and more. When you start offering contractor financing, make sure it's mentioned in every ad. It can be as simple as adding 'financing available' under your logo or in your advertising.

Offer Financing to Every Customer — Don’t let a conversation with a potential customer go by without mentioning that your offer financing. Emphasize that this can give them the option to expand the size and quality of their projects. Mentioning this option upfront will generate more serious leads.

Include Financing Options in Bids and Estimates — When you provide an estimate for work on a house, let a customer know about their financing options right away. Customers are often overwhelmed by sticker shock when they find out how much money a project is going to cost them. One way to help soften this blow is by providing detailed information about financing and how convenient it is. You don't want to miss out on a job because customers are hesitant about a price tag when financing is available to help them!

Understand the Plans You Offer — Serious prospects will want to know a little more about your financing options, beyond the fact that they're available. Read up on your plans and become familiar with your lending company's offerings. EnerBank provides training resources and marketing materials so you can understand the financing options and better explain them to your customers. Today's customers want options, and they want to be informed and educated when they make a decision. Be prepared to discuss plans with them and provide them with the resources they need to make an informed decision.

Provide the Options Customers Want — When offering a variety of options, the likelihood you'll have the solution that a customer needs increases, making it easier to close the job. Remember that all your customers have different financial needs and there isn't a “one-size-fits-all” solution when it comes to financing.

Partner with a Reputable Lending Company — A trustworthy lender partner will take care of all the details of financing for you, so you can focus on what you do best. Make sure to carefully research your options and ask questions about any partners you're considering. EnerBank is a trustworthy and stable bank that can support both you and your customers. We manage loan application and accounts, providing these services to your customers securely and professionally.

Join a Loan Program with Regions | EnerBank USA

Your customers deserve options, and you deserve the chance to grow and gain an edge over the competition. For a great market advantage, start offering EnerBank payment options to your customers. We're available to contractors and customers across the United States.

Get started today with the products, tools, and resources you need to grow your business by offering your customers financing options.

Frequently Asked Questions

- QWhat kinds of projects can I use financing for?

- AFrom the foundation all the way up to the roof — inside, outside, large, or small — our loans are tailored to meet hundreds of improvement types. Contact us to discover which loans will best suit your business model.

- QWill offering financing delay my sales process by adding a step?

- ANo. Though it may seem counterintuitive, adding financing can actually speed things up. Our goal is to help you reorganize your process when you offer financing, not slow it down. Our paperless application methods and quick credit decisions mean the customer can be approved for a loan while you're still in the home.

- QWhat's the difference between secured and unsecured loans?

- ASecured loans require collateral while unsecured loans don't. Unlike secured loans, a homeowner can obtain an unsecured loan quickly and without having to risk their real property or add a lien on their home. Customers with a wide range of credit scores can receive approval for these types of loans. EnerBank loans are unsecured.

- QAm I responsible if my customer doesn't make their loan payments?

- AEnerBank loans are all non-recourse for you, the contractor. That means we assume all the credit risk. We'll never pull funds back from you if a customer is delinquent or defaults on their loan.

- QAre there other ways for my customers to apply for a loan?

- AYes. You can add our convenient banners and buttons to your website and marketing materials. Homeowners will then be able to use PreQualify or apply for a loan on their own time.

- QWho can I talk to if I have questions about my loan program?

- AUpon joining, you'll be assigned your very own relationship manager. They'll act as your strategic consultant and finance coach, helping you experience the full benefits that payment options provide.

- QHow do I manage my loan program?

- AAs a part of your program, you'll have access to PartnerPortal, your one-stop shop for tracking and managing your customer's loans. There's both a desktop and mobile version, and you can download it for free from the App Store or Google Play.