Looking to grow your business while providing homeowners with an exceptional customer experience? Offering contractor financing for clients through Regions | EnerBank is the answer. With over two decades of deep experience in the home improvement industry, we speak your language and understand your challenges. Working together, we help your customers' dreams come true while giving you a true leg-up on the competition.

We provide contractor financing for all aspects of home improvement, including HVAC, roofing, exterior remodel, foundation repair, interior remodel, residential painting, windows and doors, hardscape, fencing, and much more.

EnerBank is the trusted home improvement lender, providing the ease and convenience your customers want to get the home of their dreams.

Service Stability Convenience

America's Home Improvement Lender of Choice

We've built our whole business around the unique needs of home improvement contractors like you. EnerBank gives you the strength and service of a regulated bank, along with the ingenuity and ease-of-use that comes with decades of experience in your world.

What Is Contractor Financing?

Contractor financing is a way for home improvement professionals like you to work with a lender like us to offer your homeowner customers an easy way to pay for their project. Unlike other forms of financing, our payment options are tailored to home improvement projects, and make it easy for your customer to apply for the loan that best suits their needs.

Why offer financing from EnerBank? When homeowners have to look for ways to pay for their project, they're more likely to shop around for another bid, rather than sticking with you. If you offer a great way to pay, you'll close more deals. It's that simple.

And our loan products are designed specifically for home improvement financing — you'll get the peace of mind of working with a finance provider that's funded more than $12 billion in home improvement projects.

How Do Contractors Offer Financing to Their Customers?

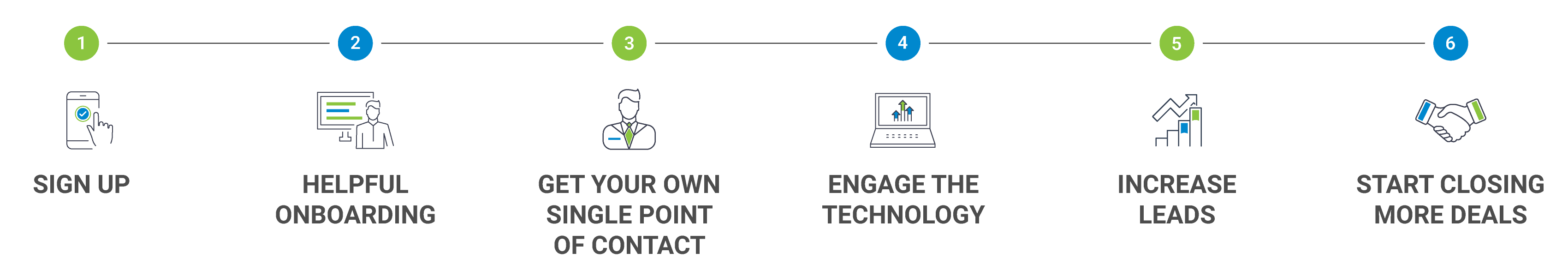

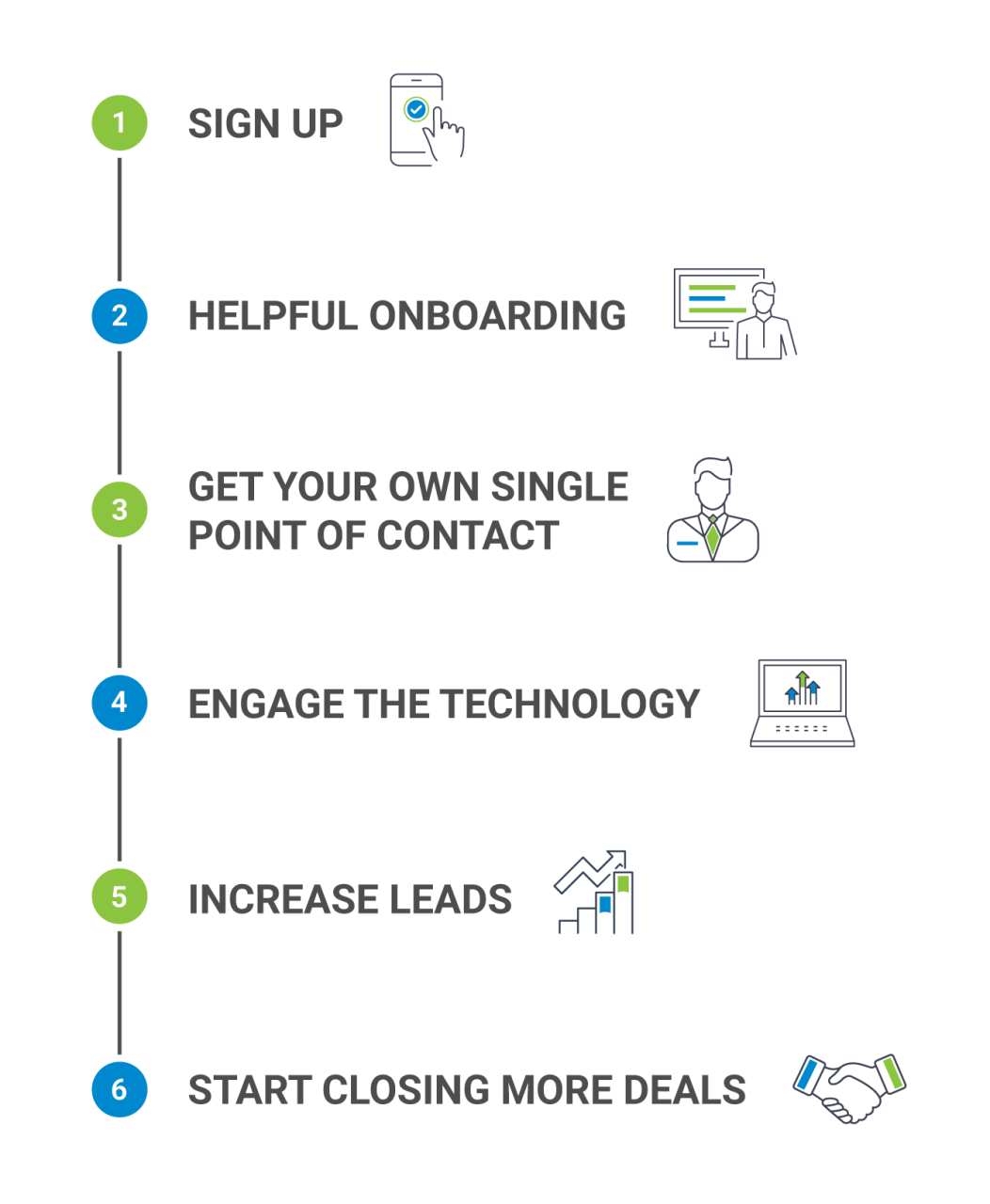

You've most likely heard of other contractors offering their customers payment options, like Same-As-Cash financing. Maybe you've even asked yourself, “How can I offer financing to my customers?” It turns out the process is easy.

To get started click here. Or you can call us at 888.704.5376

In as little as three weeks, you can join the thousands of contractors who offer competitive and attractive financing options from EnerBank to their customers. During your onboarding, we'll provide training and helpful tools to make sure you're set up for success.

What to Look for in a Home Improvement Lender

Is your loan provider reliable? Do they have the right loan products? Can they fulfill their funding commitments? These and many others are ones you should ask when selecting a loan provider. See our Everything You Should Know About Your Home Improvement Lender to learn more about the Regions | EnerBank Difference.

Why Should Contractors Offer Financing?

- Increase the chances for business expansion: About 50% of customers finance projects over $5,000. When you advertise financing to your customers, you could see a significant increase in leads.

- Stay ahead of your competitors: When you don't offer home improvement financing options, you could be leaving behind 50% of your business. Those lost customers end up with a competitor, leaving you to settle for the leftovers. By offering financing options, you can retain those customers and stay ahead of the competition.

- Provide customers with options: Financing options let you offer various products at different price points that can fit almost any budget — a “good, better, best” approach to your sales process. When customers see they have greater spending power and more flexibility in their choices, they can be more confident in their decisions and often spend more.

- Boost your close rate: Offering the right payment options can almost double your close rate. We've found that companies with a 25% baseline can increase their close rate to 44% when they offer a choice of a same-as-cash loan and a low monthly payment loan.

*Based on the Brickyard Study commissioned by EnerBank USA, 2018.

Best Practices for Offering Customer Financing as a Contractor

No matter how experienced you are as a contractor, our best practices for selling customer financing can help boost your business even more:

- Make sure everyone knows. If potential customers know from their very first interactions with you — online, flyers, or on your trucks — that financing is an option, they’ll be much more likely to make your phone ring.

- Keep the communication flowing. After your customer sees your marketing and calls to schedule an appointment, keep your messaging consistent and make sure they know financing will be an option they can learn more about during their appointment.

- Present the options confidently. You already know your skills and your services like the back of your hand; make sure you know just as much about the options your clients have for paying you! Offering these options confidently as a natural part of your sales and closing process instills confidence and will help you close more, and higher ticket deals.

- Make the setup easy for the customer. Make the process of closing the deal as easy and painless as possible. EnerBank's simple paperless application methods make closing deals quick and easy.

Frequently Asked Questions

- QHow Does Contractor Financing Work?

- AWhen you work with a home improvement lender, they take care of the financing side of the business so you can focus on the work at hand. When providing a bid, mention the availability of payment options, and have the homeowner apply for a loan. Depending on the lender you work with, the proceeds of the loan may go directly to you, or they may go the homeowner who then pays you. You can then begin the project and start requesting the needed funds. The customer will then make their payments to the lender.

- QWhat Are the Best Contractor Financing Options?

- AThere are a lot of options out there when it comes to picking a contractor financing provider. It's important to ensure that whoever you work with is stable, secure, and has experience in the home improvement industry. They should also provide a variety of loans that match both the needs of your business and your customers.

- QHow Do Contractors Sign Up to Offer Financing?

- AIt depends on the lender with which you want to work. Some may have parameters on who can join, such as being part of an association, while others are open to all contractors. You may have to meet certain criteria, such as years in business or annual sales, to qualify to join certain programs. EnerBank helps you through the process at every step.

- QWhat Size Home Improvement Projects Are Best to Finance?

- APayment options are a great fit for any size of home improvement project! Whether it's customers who were planning on paying with cash or homeowners who don't know where they'll get the money they need, there are benefits for everyone. Research shows that over 55% of home improvement projects are financed in some way*.

- QHow Do Contractor Financing Companies Make Money?

- AThe main source of income for most home improvement financing companies is the interest on homeowner's loans. Some providers and loan products may also require fees, such as charging a contractor more for loans that have a lower or no interest rate. Loans with lower interest rates are more attractive to your customers, making them more likely to choose you for the project.

*Based on the HIRI TFG Monthly report, released October 2023